ETH Price Prediction: Analyzing the Path to $4,500 and Beyond

#ETH

- Technical Consolidation: ETH is trading below the 20-day MA but showing signs of potential breakout with improving MACD momentum

- Institutional Accumulation: Major players like BitMine significantly increasing ETH holdings indicates strong institutional confidence

- Ecosystem Growth: $40M+ in new funding initiatives and TradFi integration projects creating fundamental support for price appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Consolidation Pattern Near Key Moving Average

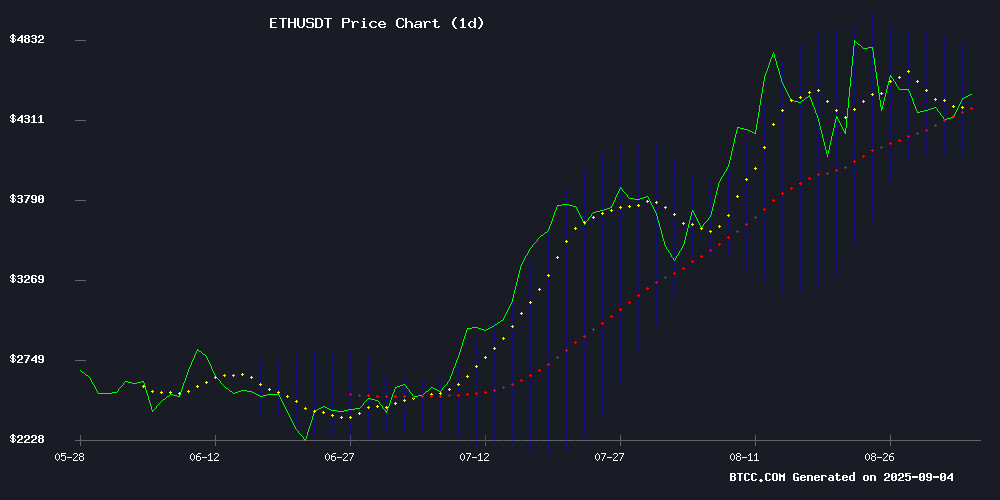

ETH is currently trading at $4,377.35, sitting just below the 20-day moving average of $4,441.21, indicating potential resistance at this level. The MACD reading of -55.55 with a signal line at -81.34 suggests ongoing bearish momentum, though the positive histogram of 25.79 shows some buying pressure emerging. Bollinger Bands position the price between $4,073.45 (lower) and $4,808.97 (upper), with the current price hovering NEAR the middle band, typically signaling a period of consolidation.

According to BTCC financial analyst Mia, 'The technical setup suggests ETH is in a consolidation phase after recent volatility. A break above the 20-day MA could trigger movement toward the upper Bollinger Band around $4,809, while failure to hold current levels might test support near $4,073.'

Market Sentiment: Institutional Adoption and Ecosystem Growth Support ETH Bullish Thesis

Recent developments paint a fundamentally strong picture for Ethereum. BitMine's doubling of ETH holdings to nearly 2 million tokens signals strong institutional confidence, while Ondo Finance's launch of 24/7 tokenized trading bridges traditional finance with Ethereum's ecosystem. The ethereum Foundation's strategic ETH sale for ecosystem funding and ArbitrumDAO's $40M DeFi incentive program demonstrate sustained investment in network growth.

BTCC financial analyst Mia notes, 'The convergence of institutional accumulation, TradFi integration through projects like Ondo, and substantial ecosystem funding creates a compelling bullish narrative. While technicals show short-term consolidation, these fundamental drivers support longer-term price appreciation potential.'

Factors Influencing ETH's Price

BitMine Doubles Ethereum Holdings to Nearly 2 Million ETH

BitMine (BMNR), an Ethereum-focused microstrategy company, has significantly expanded its position in the cryptocurrency market. The firm acquired an additional 80,325 ETH, valued at $358 million, from institutional partners Galaxy Digital and FalconX. This brings BitMine's total Ethereum holdings to 1,947,299 ETH, worth approximately $8.69 billion.

The acquisition solidifies BitMine's status as the largest holder of Ethereum, with holdings more than double those of its closest competitor, SharpLink. The aggressive accumulation strategy underscores BitMine's ambition to dominate the Ethereum treasury space, backed by major institutional investors.

Market observers note that BitMine's moves reflect growing institutional confidence in Ethereum's long-term value proposition. The company's positioning could influence broader market dynamics as it seeks to capture a larger share of the Ethereum ecosystem.

Ondo Finance Launches 24/7 Tokenized Trading for US Stocks and ETFs

Ondo Finance has introduced a groundbreaking platform, Ondo Global Markets, enabling round-the-clock trading of tokenized US stocks and ETFs on the Ethereum blockchain. The service offers real-time settlement for over 100 assets, including major stocks like TSLA and AAPL, bridging the gap between decentralized finance and traditional markets.

The launch marks a significant milestone in blockchain-based finance, providing global investors with uninterrupted access to Wall Street assets. Ondo's infrastructure eliminates traditional market hours constraints and settlement delays, offering a seamless fusion of DeFi flexibility with institutional-grade liquidity.

This innovation represents a fundamental shift in asset accessibility, with plans to expand offerings to hundreds more tokenized securities. The platform's debut includes some of the most substantial on-chain selections of US equities and ETFs to date, all backed by traditional market liquidity.

Ethereum Price Outlook: Is ETH Gearing Up to Cross $4,500?

Ether hovers near $4,470 as of September 3, 2025, testing a critical juncture between $4,300 support and $4,500 resistance. Market direction hinges on macroeconomic data and institutional flows this week.

A decisive close above $4,500 with rising volume could propel ETH toward $4,700-$4,950, with $5,000 as a psychological milestone. August's $1.08 billion spot ETF inflows—the fourth-largest weekly total—signal robust demand.

Options markets show less bearish skew for ETH than Bitcoin, while sustainable perpetual funding rates suggest room for upside. Failure to hold $4,300, however, may trigger a retreat to $4,200 support, particularly if ETF flows reverse.

Ethereum Price Eyes $6K as Analysts Watch Key Resistance Break

Ethereum's price consolidation near $4,411 has traders anticipating a decisive move. The $4,450–$4,500 resistance zone now serves as the critical threshold—a breakout could propel ETH toward $6,000, fueled by whale accumulation and sustained ETF inflows.

Technical charts show $4,500 as a confluence of Fibonacci resistance and trendline pressure. A confirmed daily close above this level would target $4,729, with $4,957 as the next major test. Failure to hold risks a retreat to supports at $4,381 or $4,237.

Meanwhile, altcoins like MAGACOIN FINANCE emerge as speculative plays for 2025. Market participants are monitoring volume patterns at ETH's pivotal resistance, where the next candle close could determine the short-term bullish thesis.

Ethereum Price Prediction Weakens as Remittix Gains Traction

Ethereum's 2026 price outlook has dimmed amid broader crypto market uncertainty, with analysts now eyeing resistance levels near $4,500. The second-largest cryptocurrency by market cap dipped 1.75% to $4,329.94, despite recording $3.95 billion in institutional inflows during August—outpacing Bitcoin's $301 million outflows.

Market participants remain cautious as ETH oscillates between $4,100 and $4,500. A decisive break above resistance could signal renewed bullish momentum, while failure to hold $4,100 may trigger a retreat toward $3,500. Meanwhile, emerging projects like Remittix (RTX) are capturing attention with claims of 4,000% ROI potential by January, presenting alternative opportunities for crypto investors.

Etherealize Secures $40M Series A to Bridge Ethereum and Wall Street

Etherealize, a startup building institutional-grade Ethereum infrastructure, has closed a $40 million Series A round co-led by Electric Capital and Paradigm. The funding accelerates development of zero-knowledge privacy systems and settlement engines for tokenized fixed-income markets.

"This marks the beginning of the 'Institutional Merge' - upgrading finance to modern, global rails," said co-founder Danny Ryan, formerly of the Ethereum Foundation. The raise follows earlier backing from Vitalik Buterin and comes as traditional finance increasingly embraces blockchain.

BlackRock's recent Ethereum-based money market fund and JPMorgan's expanding Kinaxis platform demonstrate growing institutional demand. Etherealize positions ETH as a reserve asset while engaging regulators, aiming to make Ethereum the invisible backbone of institutional markets.

Ethereum Foundation Announces Strategic ETH Sale to Fund Ecosystem Growth

The Ethereum Foundation revealed plans to sell 10,000 ETH (approximately $43 million) through staggered transactions on centralized exchanges. The move aims to fund ongoing research, development, and grant programs while minimizing market impact.

This treasury decision follows a temporary pause in the Foundation's Ecosystem Support Program applications as it restructures its grant allocation process. In Q1 2025 alone, the organization distributed over $32 million in funding for community projects and protocol development.

The Foundation's June 2025 treasury policy formalized its approach to balancing ETH holdings with fiat reserves. While liquidating portions of its ETH position, the organization maintains its long-term commitment to Ethereum's growth.

ArbitrumDAO Launches $40M DeFi Incentive Program to Boost Ecosystem Growth

ArbitrumDAO has initiated the first season of its DeFi Renaissance Incentive Program (DRIP), allocating 24 million ARB tokens—worth approximately $40 million—to stimulate decentralized finance activity on its network. The program targets leveraged looping strategies for yield-bearing ETH and stablecoins, with rewards directed to users of protocols like Aave, Morpho, and Euler.

The initiative, approved by ArbitrumDAO in June, spans four seasons with a total budget of 80 million ARB tokens. Each phase focuses on distinct DeFi use cases to enhance liquidity and innovation. "This framework ensures protocols driving meaningful DeFi advancements receive support, while users gain optimized opportunities on Arbitrum," the team stated.

Morpho, Euler, and Maple Finance have already expanded to Arbitrum in anticipation of DRIP's rollout, citing its potential as a catalyst for growth. Kirk Hutchison of Morpho highlighted the program's role in attracting native DeFi liquidity and improving rates for integrations like Gemini Onchain's Earn feature.

Could ONDO Crypto Become the Gateway for TradFi On-Chain?

ONDO price surges 12% intraday as technical and fundamental factors converge. A symmetrical triangle breakout signals potential upward movement, with targets at $3.70-$4.00.

The launch of ONDO Global Markets marks a pivotal moment in tokenizing traditional finance. Starting September 3, users can trade tokenized stocks and ETFs directly on Ethereum through xSTOCKs tokens.

Market optimism grows as Ondo Finance bridges the gap between decentralized and traditional finance. The project's innovative approach could accelerate institutional adoption of blockchain technology.

Silent Data Joins Ethereum’s Superchain as First Privacy-Focused Layer 2

Silent Data, a privacy-centric Ethereum Layer 2 network developed by Applied Blockchain, has become the inaugural privacy-focused chain to integrate with Ethereum’s Superchain. Built on the OP Stack, the London-based project enables organizations to deploy blockchain applications without compromising sensitive data, merging programmable privacy with scalability and regulatory compliance.

The Superchain, a coalition of over 30 Layer 2 networks, now includes Silent Data alongside notable participants like Coinbase’s Base, OP Mainnet, and Kraken’s Ink. Silent Data distinguishes itself with a privacy wrapper, allowing sensitive on-chain operations while maintaining transparency and composability.

Applied Blockchain CEO Adi Ben-Ari emphasized the strategic advantage of leveraging the OP Stack, citing its robust ecosystem and widespread adoption. The project has already launched a suite of privacy-enabled applications and is undergoing industry trials, with Tokeny among early adopters.

Paradigm’s Reth Client Bug Briefly Freezes Ethereum Mainnet Nodes

A technical flaw in Paradigm’s Ethereum execution client, Reth, disrupted operations for a portion of mainnet nodes, underscoring the fragility of client diversity in blockchain ecosystems. The bug, rooted in faulty state root computations, stalled nodes running Reth versions 1.6.0 and 1.4.8 at block 2327426.

Georgios Konstantopoulos, Paradigm’s CTO, confirmed the incident via social media, providing recovery commands for affected operators. The disruption highlights the risks of alternative clients in critical infrastructure—even as Ethereum’s network continued processing transactions unimpeded elsewhere.

How High Will ETH Price Go?

Based on current technical indicators and fundamental developments, ETH appears positioned for potential upward movement toward the $4,500 level. The combination of strong institutional accumulation, growing TradFi integration, and ecosystem investment creates favorable conditions for price appreciation.

| Price Level | Probability | Key Drivers |

|---|---|---|

| $4,500 | High | Breaking 20-day MA resistance, institutional demand |

| $4,800 | Medium | Upper Bollinger Band, ecosystem growth momentum |

| $6,000 | Low-Medium | Sustained bull market, major adoption milestones |

BTCC financial analyst Mia suggests, 'The $4,500 level represents the most immediate target, with a break above the 20-day moving average serving as a critical catalyst. However, traders should monitor MACD momentum for confirmation of sustained upward movement.'